Vehicle I

Vehicle I

Vehicle I

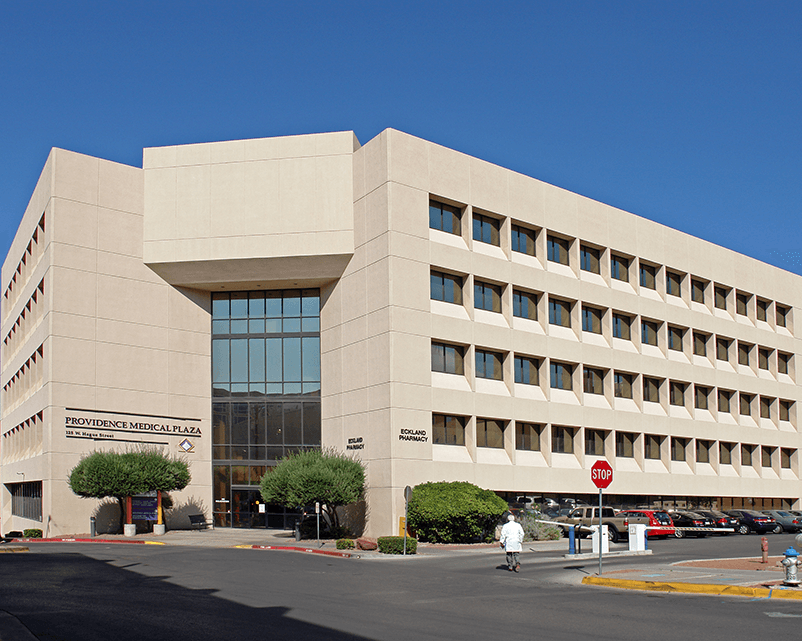

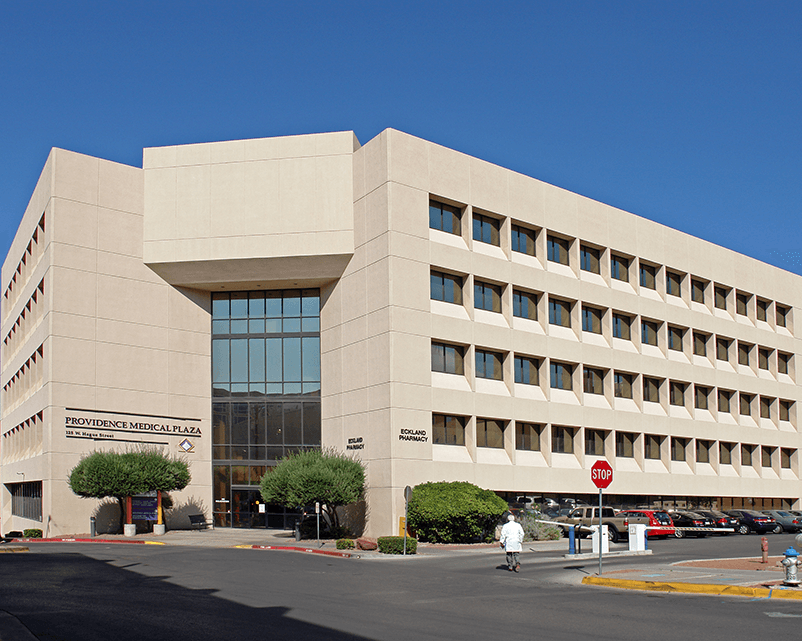

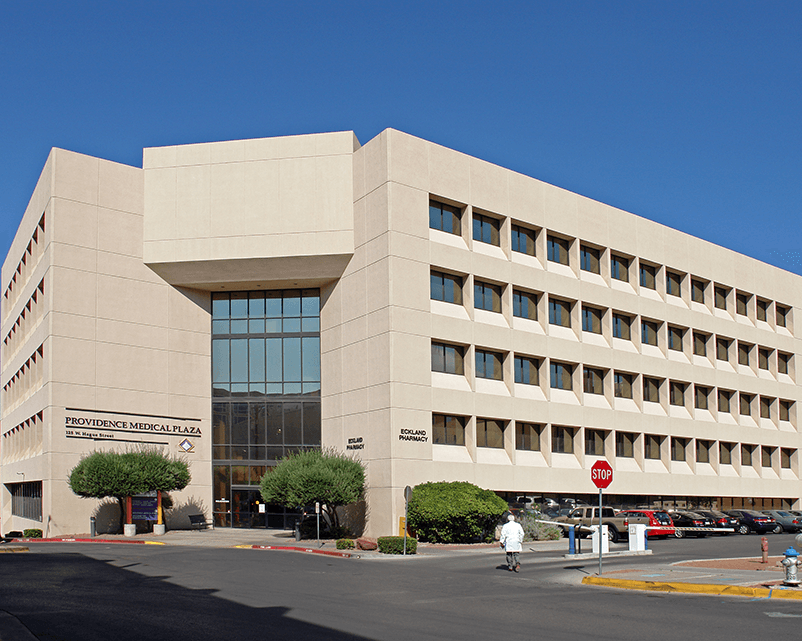

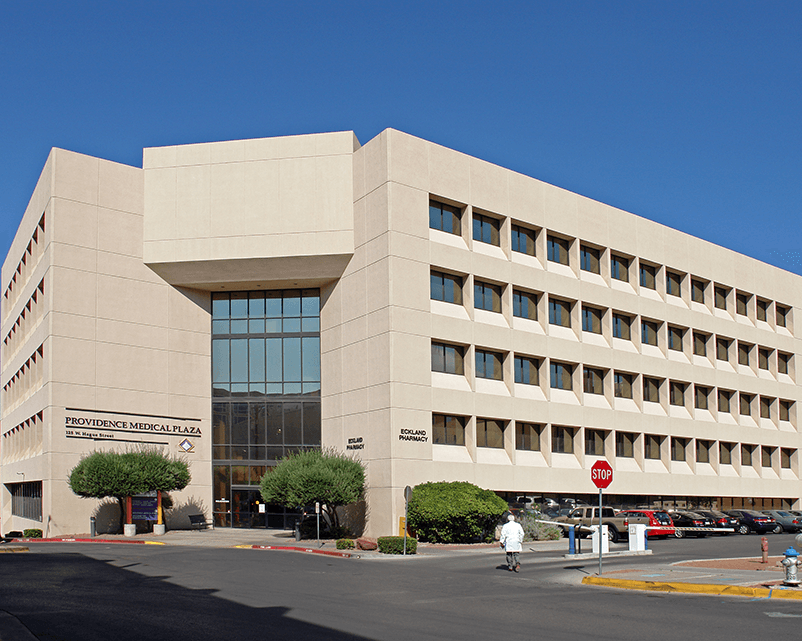

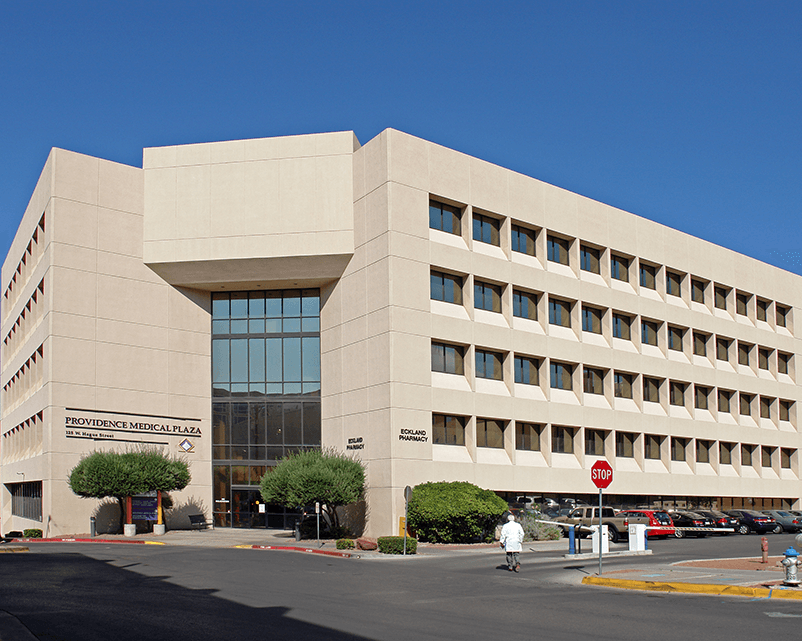

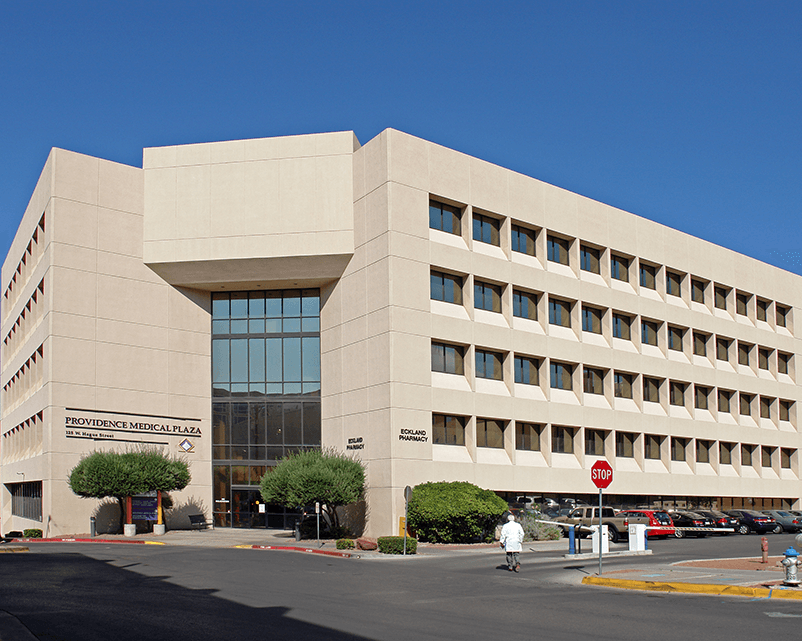

Altera acquired a portfolio of seven (7) on-campus medical office buildings from Tenet Hospitals in Q4 2011 at a substantial discount to replacement cost. Altera implemented substantial capital improvements including updates to all mechanical systems and elevators as well as updated cosmetic interior improvements throughout the portfolio. The improvements, coupled with an aggressive leasing strategy, led to occupancy increasing from approximately 68% at acquisition to over 90% at disposition. Altera sold the portfolio to HTA REIT in Q2 2016.

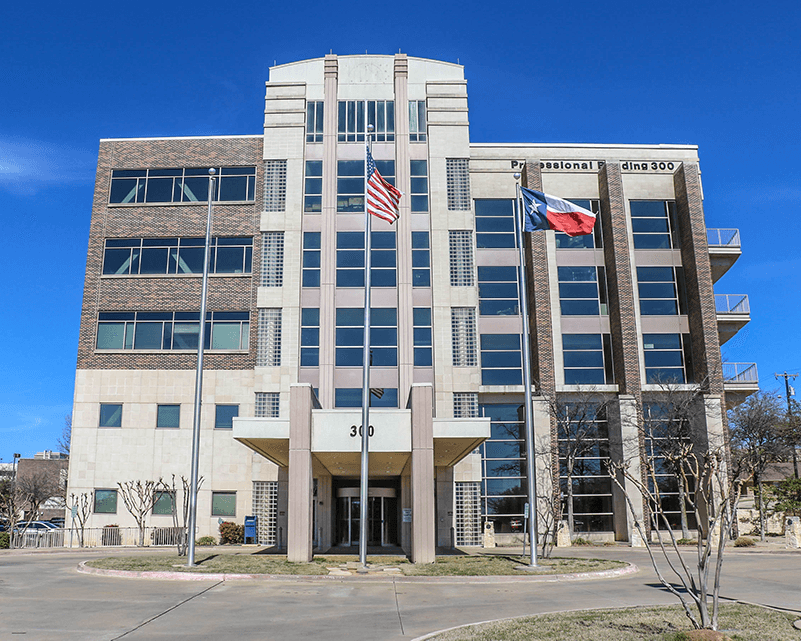

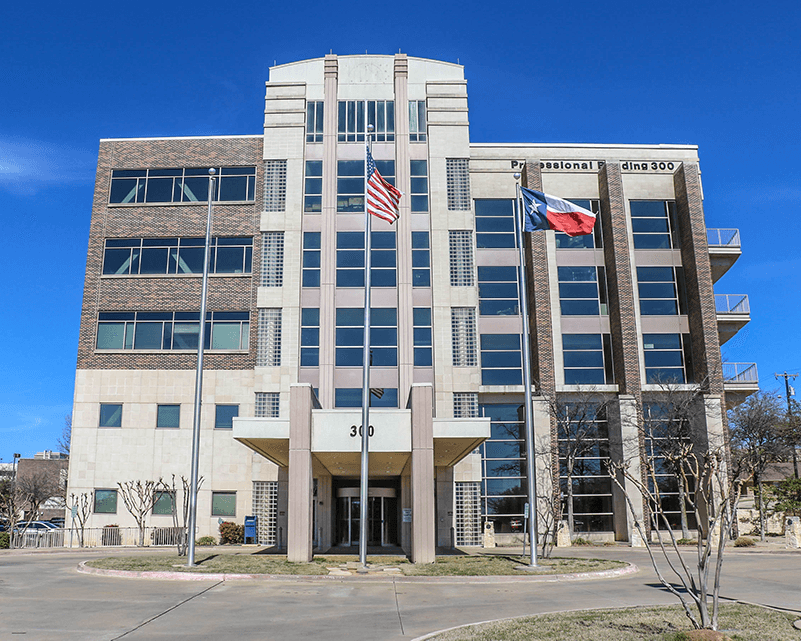

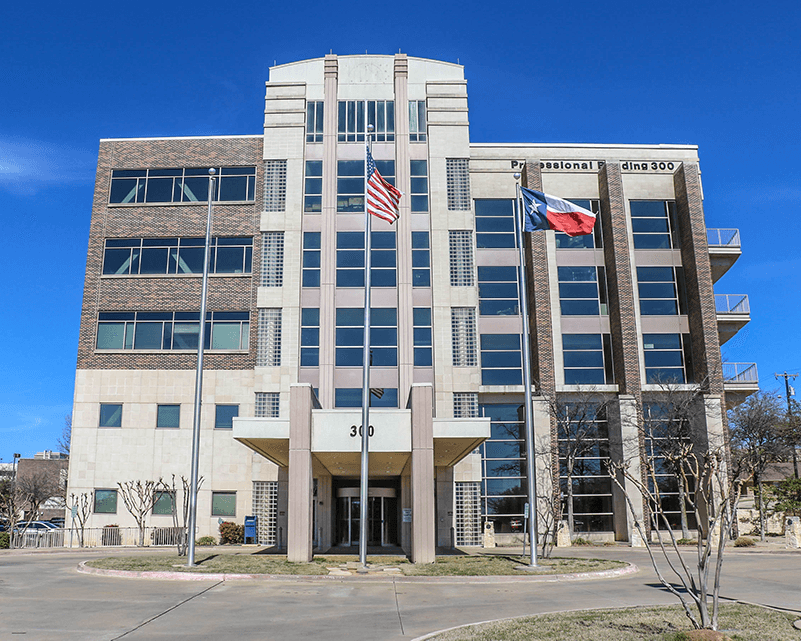

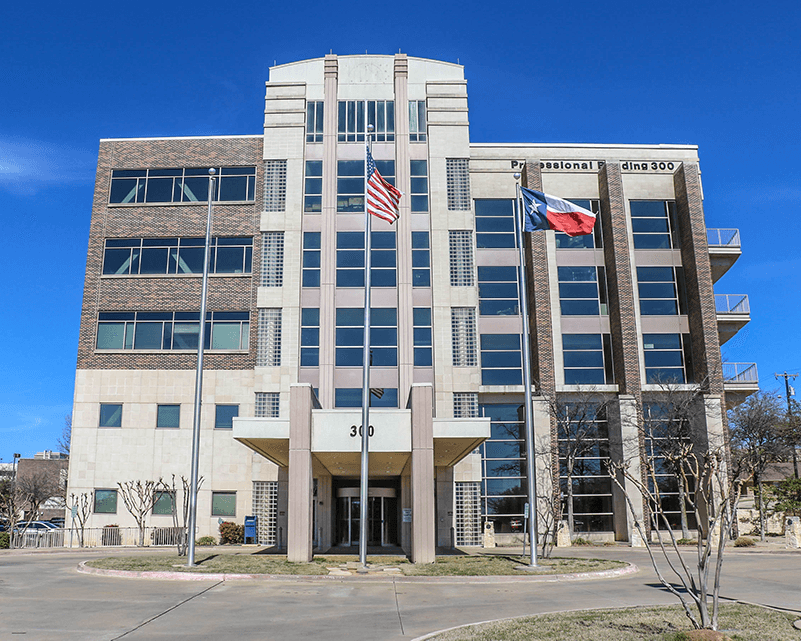

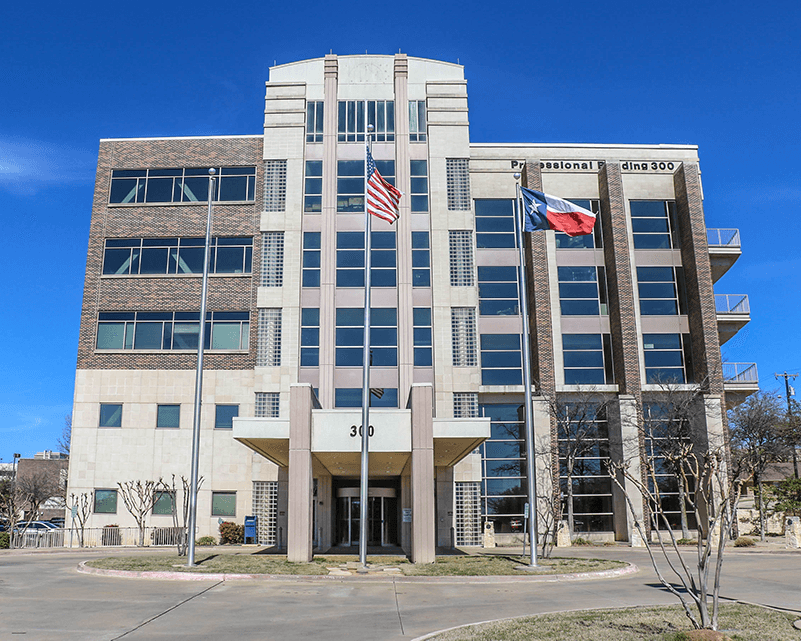

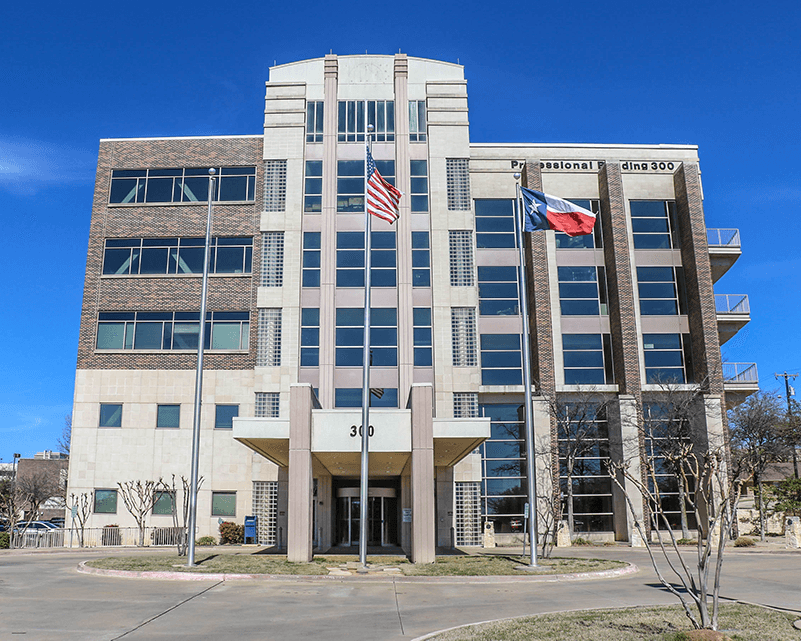

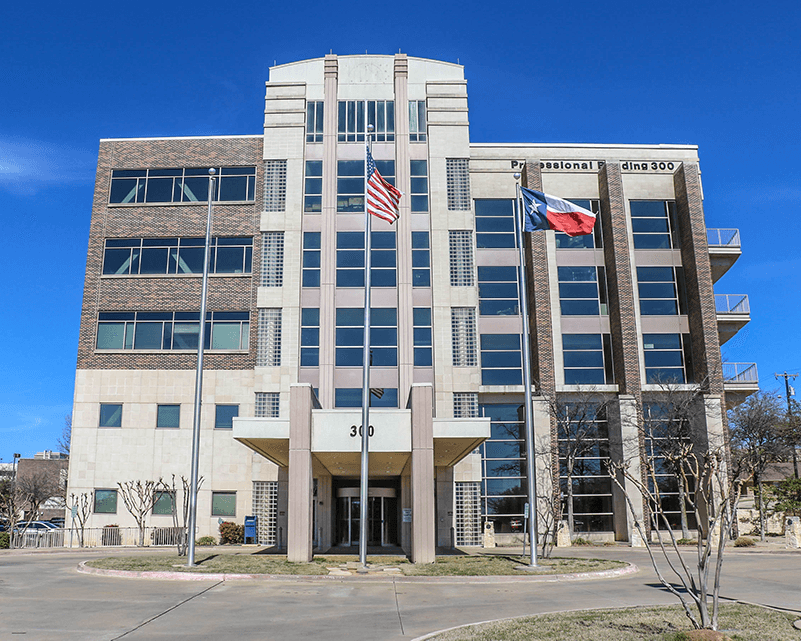

Altera acquired the Wilson Jones on-campus medical office building through a sale leaseback transaction with Legacy Hospital Partners (LHP) in Q3 of 2012. LHG was the lead JV partner in the hospital with Texas Health Resources. In conjunction with the refinance, the property was recapitalized in December 2015, resulting in strong returns to the lead investor. The principals of Altera continue to own this property.

Altera acquired the Hugh R Black medical office building, located on the campus of Mary Black Hospital, from HTA in Q3 2018 at a substantial discount to replacement cost. The building had been on master lease since it was constructed. Upon expiration of the master lease, Community Health Systems (CHS), the owner at that time, only renewed its lease for approximately 65% of the building.

Based on CHS’ balance sheet-driven disposition activities, Altera anticipated that the hospital would sell to another operator. Hospital bed supply and demand in the Greenville/Spartanburg MSA, coupled with the fact that South Carolina is a Certificate of Need (CON) state, gave us confidence that the hospital would not be shuttered. Ninety (90) days post-ownership, Mary Black Hospital was sold to Spartanburg Regional Healthcare System, one of South Carolina’s largest not for profit healthcare systems.

As of Q2 2020, the project is approximately 93% leased.